4 Back-flush accounting

4.1 The basic concepts of back-flush accounting

§ In traditional accounting systems inventory is a key item. Traditional manufacturing firms hold high levels of inventory for raw materials, work-in-progress (WIP) and finished goods.

§ Much of the work of the management (or cost) accountant would be to place a value on this inventory, e.g. using process cost accounting.

§ Back-flush accounting is an alternative approach to cost and management accounting that can be applied where:

- the speed of throughput (or ‘velocity’ of throughput) is high, and

- inventories of raw materials, WIP and unsold finished goods are very low.

§ Instead of building up product costs sequentially from start to finish of production, back-flush accounting calculates product costs retrospectively, at the end of each accounting period.

Illustration 7 – Targeting costs

A key performance target for many banks is to reduce staff costs as a percentage of total bank costs.

The launch of first telephone banking and then internet banking for personal customers (both services enabling bank customers to access their bank accounts, transfer funds and pay bills on a 24-hour basis) has enabled the banks to vary the level of bank staff involvement in the provision of these services and to provide a relatively cost-effective service.

4.2 The accounting aspects of back-flush accounting

§ Back-flush accounting offers an abbreviated and simplified approach to costing by getting rid of ‘unnecessary’ costing records.

§ In the examination you will not be required to perform the double entry for back-flush accounting.

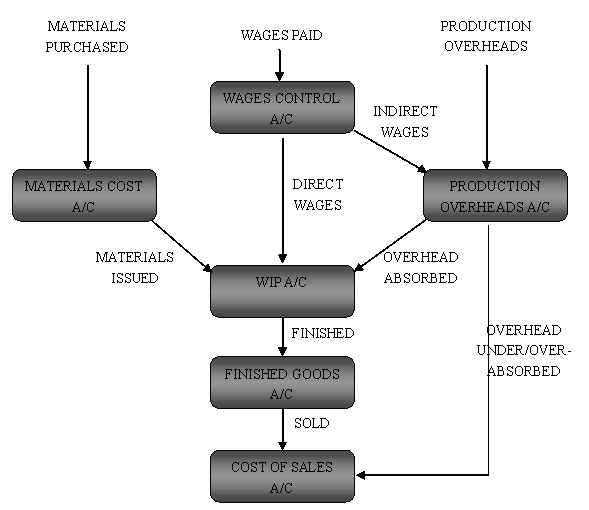

A traditional system

§ A traditional costing system will include the following Τ accounts:

§ The figures for closing inventory in materials, WIP and finished goods are the remaining balances carried forwards after other entries have been made.

§ For example, in the WIP account the value of closing WIP is the balancing figure after the cost of finished goods has been transferred out to the finished goods account.

§ The figures are built up from expenses being incurred through to cost of goods sold.

§ Variances can be calculated at each stage (e.g. materials price, materials usage, etc.)

§ Where process production is involved, these T-accounts will be repeated for each process with the output of one process being the input for the next.

A back-flush accounting system

§ The cost of raw materials is allocated to a ‘raw materials and in progress’(RIP) account.

§ Conversion costs (labour and production overheads) are allocated straight to the cost of goods sold account.

§ At the end of the accounting period an inventory stock-take is carried out to determine closing balances for raw materials, WIP and finished goods. This is quick as there are few inventories. Inventory values are based on budget/standard costs.

§ The closing inventory values for raw materials and WIP are then ‘back-flushed’ from the cost of goods sold account into the RIP account.

§ Similarly the closing inventory value for finished goods is ‘back-flushed’ into the finished goods account.

§ Thus with back-flush accounting there will be a significant reduction in accounting costs albeit at the cost of reduced detail. (e.g. a split of conversion costs between production labour and overhead is not available).

§ However, as noted above, if the production cycle is short and there is only a small amount of WIP at any time, it is questionable whether there is much value in building up detailed cost records as items progress through production. This is key to back-flush accounting.

§ In process production systems back-flush accounting often combines all processes into one.

Test your understanding 8

Target costing is best understood as finding:

(a) What a new product or service actually costs.

,我们将会及时处理。

,我们将会及时处理。